Singapore is the land of opportunities. With an unemployment rate under 2%, it ranked 1 in ‘ease of business.’ Expanding the business into Singapore can be a good decision. Stop, stop that thought process right there!! Please don’t set up the business in Singapore; it will cost you tons of cash and time. Use Singapore PEO instead.

Contrary to popular belief, the easiest and most cost-effective way of tapping the Singaporean market is by not setting up a legal entity. The smart way to test your business in foreign waters or hire staff would be using Singapore PEO and EOR arrangements. In short, Singapore PEO will be a boon for companies that:

- Do not have legal set up in Singapore to hire staff

- Want to test the Singaporean market without breaking the bank

- Do not have the human resources to hire people in Singapore

The next level of growth as a business owner is to get into overseas expansion. However, international expansion could be more manageable in managing compliance with foreign employment regulations. In addition to that, getting the right human resources is important.

Thankfully in MME, you will have qualified help at hand. We will help with many compliance and HR needs. But first, let’s concentrate on why you need Singapore PEO in the first place.

Why Do You Need a Singapore PEO to Expand?

In previous paragraphs, we talked about expanding overseas. But this comes with its major hurdles. A) managing your risk properly, B) adhering to the regulations of the country in which you are expanding.

It is where the use of Singapore PEO comes in. For the last 30 years, PEOs have come to the front lines in helping organizations with international aspirations. The PEO industry has become so common that their 175,000 clients now represent 15% of employers with an average of 10 to 99 employees in the United States.

Singapore also has shown a rise in relying on agencies to supply staff on a contract or recurring basis. Without further ado, let’s jump onto how a PEO can mitigate your expansion risks.

Lower Risk

Testing foreign markets is mingled with financial risks, regardless of country. Setting up a local entity needs significant investment regardless of the expansion structure. So adding financial risk to regulatory compliance is hardly prudent.

Partnering with expertise on Singapore PEO, you can reach out to available resources quicker as your PEO will have established resources in that foreign market. If going by the numbers, businesses are witnessing a 35% reduction in HR administration costs.

What is more interesting is that you can easily pull out if your product is unsuitable for the market. Thanks to the fact that you don’t have overheads to pay and ultimately termination of employees in the market.

Regulatory Compliance

Every country has its own set of options and legal entities to create. The company has labour laws, local compliance laws, safety requirements, etc.

But using a Singapore PEO already established itself will be a plus point for you. As co-employers, they can act as an umbrella for all regulatory needs during the expansion process.

It means more time for you to focus on operations while Singapore PEO takes on the day-to-day HR activities. Now you can create ripples in the Singaporean market with PEO employment. Let’s know more about this.

What is Singapore PEO employment?

Singapore PEO service providers are the legal employer of staff in Singapore. But seconding the staff back to the business under a service agreement. This arrangement simplifies the expansion.

Now immediately hire and perform sale activities, market research and setup activities associated with setting up local legal entities. By tapping into dedicated Singapore PEO services, an expanding company can take a hands-off approach to the regulatory side of foreign recruitment and HR. Therefore PEO has global implications for ambitious businesses.

This arrangement allows companies to focus on growth and profit maximization without worrying about regulations and employee matters during expansion.

How Singapore PEO services can be Beneficial For Expansion

The Singapore PEO is not only the regulatory umbrella we talked about. They provide many benefits when it comes to expanding your organization.

Let’s count them one by one:

Easy Exploration of Foreign Market:

Singapore PEO allows you to give wings in exploring a new market as the PEO consultants are familiar with the location and economy.

First Mover Advantage

Expanding the business into Singapore helps you break free from the oversaturated market of your home country. If you are the first business in your niche to move to Singapore, you will always have a first-mover advantage. Allowing your strong brand recognition that will help in the future.

Access to talented professionals:

Employment under a PEO service provider is exceedingly common these days. Companies are looking for cost-effective and flexible ways to set up in Singapore. But companies are getting more concerning international employees.

International employees are sought-after professionals thanks to their language skills, diverse backgrounds and different perspectives. Therefore, business owners are getting the best-suited professionals.

Cost and time savings

As a guideline, hiring under Singapore PEO is at least 50% cheaper. The cost savings are driven by PEO employment, removing administrative costs for maintaining a legal entity. Most importantly, it will save you time with various HR administration, visa applications, employee insurance, pension and tax payments.

Even your foreign employees will benefit from these plans. That is one of the reasons PEOs reduce employee turnover by up to 14%.

Singapore PEO will do all this by charging a monthly nominal amount while you focus on your Business Growth.

Flexibility and reduced complexity

Business is all about flexibility and complex labour laws. Hiring staff under a PEO service will give flexibility. How will flexibility be the right option?

Firstly, PEO services ensure you can quickly scale up and down before taking the plunge. The second scenario is if you are six months in and want to put operations on hold and focus on other aspects. It is easy to do so. Cease the employment and try it once again when you are ready.

Try this ‘stunt’ with any legal entity. Then there would be questions about your professionalism and lack of seriousness. Also, you will be bearing all the ongoing administration costs and any other wind-down costs.

Fast Tracking Process

Obtaining approval from higher authorities in setting up a legal entity, obtaining the relevant documentation and Arranging signatories in Singapore can be a slow and lengthy process. PEO services fast-track your time by skipping all these hurdles by removing the need to set up a legal entity. Enables you to go to market in a small timeframe and that too in a single day.

Therefore, it is advantageous for companies who want a long-term engagement but want to test the market. Further, start hiring when they are close to some cash flow and avail low risk.

Therefore seeking a permanent presence. Singapore PEO looks into every aspect. You don’t have to worry about local labour laws or tax codes from onboarding to payments.

Utilizing PEO services is the best business choice to hire the right candidates to fulfill their world dominance vision. Business owners will get flexible terms tailored to their business needs and requirements. On top of that, you are giving invaluable help with accounting, business consultancy, payroll, and HR.

No matter your business needs, MME can take it to the next level and crack the Singapore market.

Employing through PEO/EOR in the Singaporean market is easy, and transitioning to regular payroll is also straightforward. If the project is permanent, open a regular payroll without going door to door. The entire transfer can be completed in a day.

Okay, we get this. Singapore is an easy process. But tell us more about its facilities. What are we getting from this?

Services of Singapore PEO

Singapore PEO can organize and facilitate the following benefits:

- Life and personal accident insurance

- Medical, vision, and dental care plans

- Disability insurance, both short-term and long term

- Benefits for commuters

- Educational assistance

- Fitness memberships

Navigation and Assistance with Foreign Laws and Regulations

In most cases, Singapore PEO can assist your organization with the following:

- Mitigating unemployment claims

- Reviewing employment verifications

- Assisting in employer health care compliance where mandated

- Addressing follow-ups on all laws of payrolls complying with the foreign market’s governments.

Reduce Your Responsibilities in Administration and Payroll

A PEO can save your valued time and effort on:

- Payroll

- Paycheck preparation and payments

- Payroll slips

- Payroll reporting

- Tax reporting

Experienced and professional HR Staff on the Ground

A PEO service provider working on your behalf in the foreign market assures you that all HR issues will be handled properly:

- Onboarding & exit

- Employee relations

- Paid family leave and other absences

- Recruiting, onboarding, and terminating employees

- Overtime management

Reduction in Organizational Liability during Expansion

PEOs are experienced in assisting you with every HR compliance issue:

- Worker’s compensation

- Interaction with local staffing agencies on your behalf

- Liability insurance

- Creation of employee guidebooks

Agreements and contracts

Well, there’s more. The services also include agreements and contracts. Some of these are

- Curating an employment contract and onboarding the employee

- Curating every employee’s insurance, I.e., employee compensation

- Singapore visa processing in the case when the employee is a foreigner and needs an employment visa in Singapore. Thus supporting employees in the onboarding process.

- Singapore salary and payroll processing, including CPF, tax and any other taxes which required statutory submissions.

- Maintenance of annual leave and sick leave records in books and systems.

- Recruitment services when you need to help the right fit and go to market quickly.

- HR support and advice on Singapore employment law and any further employment risks.

After signing off contracts, our Singapore team will schedule a meet and greet with the candidate and client. The onboarding process usually takes 3-5 days.

Apart from the above, there are Legal Liability Coverage and Termination Guidelines. Let’s know more about them.

Legal Liability Coverage

Singapore PEO Solutions covers the following functions to take legal liability as the local Employer of Record:

- Mandatory social and pension insurance enrolment.

- Witholdment of Employee income tax

- Liabilities of early termination include severance calculation and mediation.

- Onsite health and safety liability coverage, the costs of which are shared with the client.

Termination Guidelines

Suppose the client decides to pause or end their operations in Singapore. Also, there is staff employed through PEO and EOR services. No termination fees would be implied on the client as long as the client adheres to the 60-day termination notice period.

Above are the services given by every PEO service provider. But you still need to learn about how it works. Read on to know more.

How Does Singapore PEO Work?

PEO employs a batch of staff (whether recommended by yourself or sourced by the PEO) and gives you on a contractual basis for designated tasks. They have a contractual allocation and sharing of tasks. When you partner with MME, PEO will agree on various responsibilities on your behalf. Like, PEO might take care of HR support, payroll, and tax filing while the organization retains control of general operations and overall management of the employees, including upskilling.

The PEO is helping with establishing assets and infrastructure in new foreign markets. You can utilize their economies to reduce your expansion costs. Also, their policies regarding work enforcement will only help you in operations.

But before that, you will need some facts about the working culture of Singapore.

10 Facts About the Working Culture of Singapore

#1 Worldwide in Ease Of Doing Business

As mentioned, it has low unemployment rates and a quickly growing GDP. Singapore is the land of new opportunities and a hotspot for entrepreneurs to grow new businesses and international companies expanding their operations in Asia.

The key reason for this is their high level of punctuality. They respect the dignity and honor of themselves and their peers. Tardiness and unpunctuality are signs of disrespect. So ensure you are always punctual for every appointment inside the country.

Knowing local laws and regulations is inevitable when working in a new country. Not following local laws includes serious penalties for acts like jaywalking, littering, and smoking in public.

#2 – Working Hours of Singapore

Weekly work time in Singapore is regulated to 8 hours per day. It must be at most 44 hours in a week. Overtime must be compensated at 150% of the regular employee payment, depending on the employee’s status, if their salary exceeds the relevant wage gap.

#3 Employment contracts

The contracts should implicitly detail all the employee responsibilities, compensation details, benefits, grievance procedures, and protocols to follow during termination. All offer details, compensation details, or any document discussing employee income should be stated in Singapore Dollars.

Singapore’s PEO service of MME includes all these in its devices under the jurisdiction of international expansion in Singapore through the employer of record service.

#4 – Singapore Holidays

Singaporeans celebrate ten national public holidays annually. Some of these are:

- New Year’s Day,

- Chinese New Year (2 days),

- Good Friday,

- Labor Day,

- Vesak Day,

- Hari Raya Puasa,

- National Day,

- Hari Raya Haji,

- Deepavali, and

- Christmas.

#5 – Bonus Payments in Singapore

While it is not mandated by law, giving a bonus equivalent to one month’s salary or a similar annual bonus is a practice. It is like you are given 13 months’ salary every year.

Also, the value could be more generous when the Singaporean economy performs well.

#6 – Health Insurance & Employment Benefits

The Singapore national system provides health insurance to all its residents who have a working visa in Singapore. Employers sometimes exercise the option to provide their employees with add-on health insurance as an additional benefit. The process can happen during job negotiation.

Stock options or ESOPs are sought after by executives and high-level managers working for US-based companies located in Singapore.

#7 – Sick Leave in Singapore

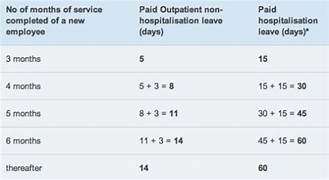

People working in any corner of the world can receive sick leave. Suppose they have been working for the company longer than three months and provide a notice from a certified medical professional. As it is customary with the sick leave policy, individuals are entitled to longer durations of leave if they have worked for longer years. The number of days for paid sick leave is directly proportional to the length of service.

Once employees have reached six months of employment service, they are entitled to 14 days of outpatient leave and 60 days of hospitalization leave.

#8 – Maternity Leave in Singapore

Female employees who are citizens of Singapore and who are legally married to the child’s father. Further, they have worked for the employers for at least three months. Then they are entitled to 16 weeks of paid maternity leave.

The maternity leave expenses are shared between employers and the government. The employer bears the first eight weeks, while the government supports the next eight weeks.

After the second child, the government must pay for every maternity leave if an employee working in Singapore is unmarried and not a citizen. Then maternity leave will be reduced to 12 weeks instead of 16 weeks for married women. Fathers are entitled to maternity leave only if they are legal citizens and married to the pregnant mother.

#9 – Termination & Severance in Singapore

During initial contract discussions and negotiating employee probationary periods, the standard practice is to give 3-6 notice periods. The standard practice regarding termination is to keep employees or employers in the loop for one month. However, there is no legal law to allow a period of probation.

#10 – Singapore’s Tax Laws

Companies are always advised to set aside a budget of 15-20% of an employee’s salary. It will be paid to the employee’s CPF ( Central Provident Fund) by the employer.

These are the top 10 facts that came to our head. There are many more. This a perfect reason to employ Singapore PEO services of MME to do the needful.

Other than this, we have picked the 11 best FAQs. It will help you deal with your questions.

FAQs

1. Who has the entitlement to CPF contribution in Singapore?

If you are on a working visa, a Singaporean, or a Singapore permanent resident, you are entitled to CPF contributions from your employer. It is payable for

- An employee working in Singapore under a contract of service

- Employment is under the scanner with part-time, permanent, and casual

-Working in Singapore under a contract of service.

-Employed on a permanent, part-time, or casual basis.

– if the employee is an SC or SPR working overseas, then CPF contributions are not mandatory.

2. What types of group insurance are available?

- Local and International Medical, Hospitalisation plan.

- Life coverage would follow an annual salary.

- International travel insurance.

3. What is the minimum wage paid in Singapore?

There is no minimum wage bar. The Singapore government encourages salaries starting from SGD 1400 in July. There is always a chance of market correction where certain benchmarks are to be followed to be more competitive. The practice is done to retain talent.

4. What is the best time for onboarding a worker?

Any time and date before the next statutory contribution deadline

5. How many days for converting around a contract once you have received employee information?

1 Working Day will be more than enough for onboarding. Or We Can always share the contract to expedite the process.

6. Can you help me name the challenges I will face in entering the Singapore market?

Setting up an entity comes with its own set of challenges. The client will need MME to assist them in setup. The challenges will be deciding on strategic marketing and hiring staff, as you cannot hire foreign staff within the first six months.

7. Can employees be seconded to other PEO companies?

The employees can be transferred to another PEO company. The employee has to make a resignation, and the client has to terminate within the conditions of the services agreement with a notice period. MM Enterprises will prepare the documentation regarding onboarding during this period.

8. What are the procedures for employees to bring their dependents to Singapore?

Employees are eligible to apply for a Dependents pass if the individual is holding an Employment Pass or S pass sponsored by a Singapore-registered company. The only other condition is that employees must earn a minimum fixed monthly salary of $6000 and then apply for a legally married spouse, Unmarried children under 21 years old, including legally adopted children.

If the family members are not allowed or eligible for Dependents pass, you can apply under the long-term visit pass.

Both Dependents pass or LTVP holders are welcome to work in Singapore if they have found a job. The hiring company needs to sign a letter of consent for them. The above services come with work pass management services enabling the family members to come together and stay together.

9. What is the procedure for applying for an employment pass?

- Job advertisement for 14 days

- Self-Assessment Tool (SAT)

- Apply after three weeks of completing SAT

- Issue of work pass within six months upon employee arrival in Singapore

- Check the notification letter for the requirements to register fingerprints and photo

- Receiving the work pass card

10. Does the PEO arrangement have a minimum and maximum period of employment?

There is no minimum or maximum period for employment. The common hiring practice will start from 1,3,6 months to an indefinite period.

Suppose you would like to watch more about the answers and questions on Singapore PEO. You can always watch the video:

(https://www.youtube.com/watch?v=l-xPVYfI0tY&feature=youtu.be).

11. What doesn’t come under the PEO job description?

While PEO services are a boon in mitigating administration, there are some areas they need to take care of. PEOs are not legal advisors with zero knowledge of tax laws. They can help you on the Ground obligations. But it is the organization’s work to regulate itself according to the foreign market.

Further, a Singapore PEO will not be responsible for running daily operations in foreign markets. It’s not within their job description. So it is the expanding organization responsible for both operations in foreign markets.

Conclusion

Overall, a PEO as an ally is invaluable to any organization with plans to expand in any foreign market. A PEO can handle many costly duties except daily operations and strategic management. Leaving to perform what you do best is growing your successful business.